In March 2008, the KFTC established the ICD to enhance its specialty in investigating international cartels. An international cartel may be defined as a group of companies agreeing to anticompetitive practices that affect multiple international markets. It is difficult to conduct direct investigations on international cartels, since the investigated parties are located abroad. So the cooperation of foreign competition authorities is indispensible to efficiently uncovering and sanctioning international cartels. Moreover, since confidentiality is essential in the course of such cooperation, the need to keep uniform the points of contact for foreign competition authorities became clear. In this context, the ICD was created to exclusively handle international cartel cases, and the officials who had experience with investigating international cartels were assigned to the ICD.

Currently, the body within the KFTC that exercises overall control over cartel cases is the Cartel Investigation Bureau, which consists of the following divisions: 1) Cartel Policy Division, which establishes regulations related to cartels as well as relevant criteria for investigation; 2) Cartel Investigation Division, which analyzes domestic cartel information, investigates the cases, and imposes corrective orders; and 3) ICD, which exclusively handles international cartel cases and cooperates with international competition authorities. The ICD is well staffed, composing of one director, four deputy directors and four investigators, and is not small, even in comparison to the Cartel Investigation Division that handles domestic cases.

According to the KFTC's business plan for 2012, which was announced on December 15, 2011, the KFTC confirmed its commitment to eradicating collusion and anticompetitive trade practices in Korea. The KFTC listed, as one of the priority items for 2012, the need to monitor cartels, and in this regard, the KFTC stated that it will aggressively go after international cartels that have negative market influences in Korea. The KFTC also declared that it will look to bolster relationships with foreign competition authorities so as to expose and levy sanctions against such international cartels.

International Cartel Cases by KFTC

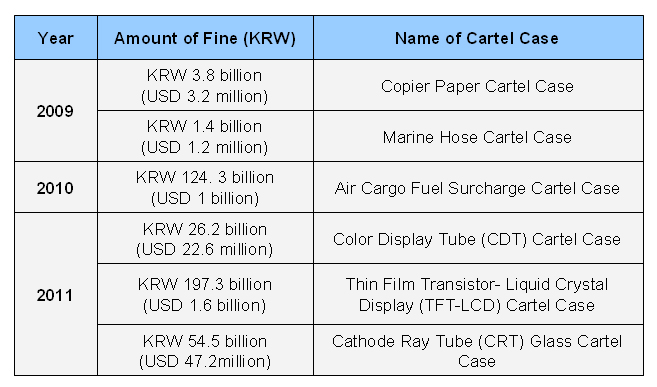

Since the establishment of the ICD in 2008, the KFTC has been active in pursuing cases against international cartels. The diagram below lists the international cartel cases pursued by the KFTC in the past three years and the respective judgment amounts. Thereafter follows more detailed discussions of individual cases listed in the diagram as well as the elaboration of our part in some of the listed cases, all followed by some important antitrust and competition law matters foreign companies doing business in Korea should be aware of.

International Cartel Cases since 2009

Copier Paper Cartel Case (PPC: Plain Photo Copier) (January 30, 2009)

Investigated Parties: Four (4) companies, PT. Indah Kiat Pulp & Paper tbk. (Indonesia), UPM-Kymmene (Changshu) Paper Industry Co. Ltd. (China), Advance Paper Company Limited (Thailand), and APRIL Fine Paper Trading Pte. Ltd. (Singapore).

Case Summary: The above four (4) manufacturers and sellers of copier paper mutually exchanged information on the price trend of pulp, which is the major material for paper, and its prospectus, trends of production, inventories, sales and orders of copier paper of each enterprise, and trends of export price of copier paper per country through periodical meetings from February 2001 through February 2004. Then they proceeded to agree on the target export price of copier paper per country in Asia Pacific region including Korea.

KFTC’s Decision: The KFTC presumed that it had jurisdiction over this case, since the investigated parties had agreed on the export price of copier paper and implemented such agreement within the Korean market, the entire volume of import price of copier paper imported to Korea from the investigated parties during the period of cartel had amounted to approximately KRW 160 billion, and as such this case considerably affected the Korean market. The KFTC ordered the investigated parties to take corrective measures and also imposed a fine of approximately KRW 3.8 billion in total on the investigated parties for their involvement in the cartel. This case was handled with the close cooperation of the Australian competition authorities based on the cooperation from the leniency applicant.

Marine Hose Cartel Case (July 3, 2009)

Investigated Parties: Six (6) companies, Bridgestone Corporation (Japan), Yokohama Rubber Company Limited (Japan), Dunlop Oil & Marine Limited (UK), Parker ITR S.r.l. (Italy), Trelleborg Industrie SAS (France), and Manuli Rubber Industries S.p.A. (France).

Summary of Case: The above six (6) manufacturers and sellers of marine hose conducted a highly organized cartel by exchanging information on bidding for marine hose in the global market, including the Korean market, deciding the expected successful bidder, and inspecting the implementation status of their agreement from January 4, 1999 through June 9, 2006 (“Cartel Period”).

KFTC’s Decision: The KFTC presumed that it had jurisdiction over this case, since the investigated parties had conspired in the bidding for marine hose in the Korean market; more specifically, they had conspired in the total of 29 biddings for marine hose with respect to Korean companies during the Cartel Period. The total scale of the cases where the successful bidder had been decided by the cartel had amounted to approximately KRW 22.7 billion, and as such this case considerably affected the Korean market. The KFTC imposed a fine of approximately KRW 1.4 billion in total against the investigated parties along with a corrective order for their involvement in the bidding cartel.

Air Cargo Fuel Surcharge International Cartel Case (November 29, 2010)

Investigated Parties: Eighteen (18) companies Korea Airlines (Korea), Asiana Airlines (Korea), Japan Airlines International Co., Ltd. (Japan), Nippon Cargo Airlines Co., Ltd. (Japan), All Nippon Airways Co., Ltd. (Japan), Thai Airways International Public Company Limited (Thailand), Société Air France (France), KLM N. V (Netherlands), Air France-KLM(France), Singapore Airlines Cargo Pte. Ltd. (Singapore), Cargolux Airlines International S.A. (Luxembourg), British Airways Plc. (U.K.), Lufthansa Cargo AG (Germany), Swiss International Air lines Ltd. (Switzerland), Cathay Pacific Airways Limited (China), Malaysia Airlines Cargo Sdn. Bhd. (Malaysia), AHK Air Hong Kong Limited (China), and Polar Air Cargo LLC (USA).

Summary of Case: Major international airlines agreed to introduce and raise fuel surcharges for air cargo on the routes to and from South Korea from 1999 to 2007. The routes involved the outbound shipments from Korea and inbound shipments to Korea from Hong Kong, Europe and Japan.

KFTC’s Decision: The KFTC imposed a fine of KRW 119.5 billion in total against the above enterprises together with the corrective order. This is the very first case in the world where all the investigated parties were subject to corrective measures through a formal hearing procedure with respect to the air cargo fuel surcharge cartel, which had been under investigation all over the world. Also, this is the largest international cartel case among those handled by the KFTC in terms of the scale, such as the number of participants in the cartel, the number of statements made by foreigners, the related turnover (KRW 6,700 billion) and the amount of fine.

Color Display Tube (CDT) International Cartel Case (March 10, 2011)

Investigated Parties: Five (5) companies, Samsung SDI (Korea), LG Philips Display (Korea), Chunghwa Picture Tubes, Ltd (Taiwan), Chunghwa Picture Tubes (Malaysia) Sdn. Bhd. (Malaysia), and CPTF Optronics Co., Ltd (China).

Summary of Case: The above five (5) CDT manufacturers agreed on price fixing and reduction in the production of CDT through multi-level cartel meetings organized according to rank, which took place more than once every month in various countries, such as Korea, Taiwan and Malaysia for about ten (10) years from November 1996 through March 2006.

KFTC’s Decision: The KFTC acknowledged the existence of the above agreement and imposed a fine of approximately KRW 26.2 billion against four (4) companies together with a corrective order. The KFTC handled this case through cooperation of investigation with foreign competition authorities such as those from the US and EU from November 2007, and they reached a decision before the competition authorities of the USA and EU did.

Thin Film Transistor- Liquid Crystal Display (TFT-LCD) International Cartel Case (December 1, 2011)

Investigated Parties: Samsung Electronics (Korea), Samsung Electronics Taiwan Corp. Ltd. (Taiwan), Samsung Japan Corporation (Japan), LG Display (Korea), LG Display Taiwan Corp. Ltd (Taiwan), LG Display Japan Corp. Ltd. (Japan), AU Optronics Corp. (Taiwan), Chi Mei Innolux Display Corporation (Taiwan), Chunghwa Picture Tubes, Ltd(Taiwan), and Hannstar Display Corporation(Taiwan)

Summary of Case: The above manufacturers agreed on the sales price fixing, reduction of production and restriction of supply of TFT-LCD panel in the global market, including the Korean market, by holding bilateral meetings and multilateral meetings in Taiwan and Korea from September 2001 through December 2006 and implemented such agreement.

KFTC’s Measure: The KFTC imposed a corrective order against the foregoing investigated parties which prevented them from exchanging information on the decision of price and production as well as information on price, production and supply, and imposed a fine of approximately KRW 197.3 billion in total.

Cathode Ray Tube (CRT) Glass Cartel Case (December 7, 2011)

Investigated Parties: Four (4) companies, Samsung Corning Precision Materials (Korea), Hankuk Electric Glass Co., Ltd (Korea), Nippon Electric Glass Co., Ltd. (Japan), and Nippon Electric Glass Sdn. Bhd.(Malaysia).

Summary of Case: The above four (4) CRT manufacturers held cartel meetings at least 35 times in various countries, including Korea, Japan and Singapore for a period of eight (8) years from March 1999 through January 2007, and agreed on fixing prices, restricting trading counterparties and reducing the production; and they implemented such agreement.

KFTC’s Measure: Although the written decision for this case has not yet been issued, the KFTC imposed a fine of KRW 545 million in total through its press release. This case was handled by close cooperation with the EU competition authorities, which included a joint dawn raid in March 2009, and the EU dealt with this case in October 2011. The KFTC handled its third international cartel case of 2011 following the CDT case in January 2011 and TFT-LCD case in October 2011. The KFTC expressed its intention to strengthen the monitoring of markets related to spare parts.

In addition to the international cartel cases, the KFTC’s investigation of multinational corporations in connection with the abuse of monopoly power is on the rise. Some examples are the following: Microsoft case in 2005 (KRW 32.4 billion); Intel case in 2008 (KRW 26.6 billion); and Qualcomm case (KRW 273.2 billion)). The amount of fines imposed is increasingly becoming higher with the fine against a single company in the Qualcomm case marking the largest in the history of cases pursued by the KFTC.

Cases Handled by Jipyong & Jisung

We have helped our clients navigate through the process of dealing with the KFTC, and the following cases are but some examples of our experience and growing prominence in the field of antitrust and competition law.

Air Cargo Fuel Surcharge International Cartel Case

We represented Malaysia Airlines Cargo Sdn. Bhd. (“MAS”), a Malaysian company investigated in this case. MAS asserted that they had not participated in the fuel surcharge cartel and that they had simply followed the policy of Korea Airlines, a national carrier. After the KFTC’s decision was rendered, MAS filed a lawsuit seeking the cancellation of the KFTC’s decision in the Seoul High Court, and the hearings were completed. Currently, MAS is awaiting the ruling of the court. We expect that the court will accept the assertions made by MAS and that the KFTC’s decision will be vacated.

TFT-LCD International Cartel Case

We represented Chi Mei Innolux Display Corporation ("CMI"), a Taiwanese company investigated in this case. CMI acknowledged their involvement in the cartel related to the price fixing of TFT-LCD and reported such facts to the KFTC. Although CMI was not exempted from paying the entire fine since they were not the first leniency applicant, the fine was reduced by eighty percent (80%) on the grounds that they had diligently cooperated during the investigation process. The KFTC ruled that CMI had been involved in both restricting production as well as engaging in the price fixing of TFT-LCD products. However, CMI will file an objection to the KFTC by the end of 2011, seeking cancellation of the KFTC's decision on the matter about restricting production, and will ask for additional reduction in the fines.

Key Legal Issues in KFTC's Investigation of International Cartels

The following are some important international cartel-related issues foreign companies that influence the Korean market should be aware of in planning their business efforts related to Korea.

Constant Expansion of Jurisdiction

The investigation of cartel cases often raises issues about extraterritorial application of competition law. Although the collusion may occur outside of Korea, if such collusion affects the Korean market, the KFTC may regulate such collusion.

So if a foreign company gains profits from Korean companies or in the Korean market, such company should always pay attention to the Monopoly Regulation and Fair Trade Act of Korea (the “Fair Trade Act”). This also applies to the case of business combination and abuse of market-dominant position, which are other areas of the competition law covers.

Movement of Foreign Competition Authorities

Although the KFTC independently investigates international cartels in many cases, they also investigate international cartels in cooperation with the U.S. and EU competition authorities. Since international cartels are carried out all over the world, the cooperation among competition authorities from different territories is indispensible to efficiently investigate and enforce the law. There have been instances where such competition authorities, recognizing the existence of international cartels, have coordinated to conduct a dawn raid in advance, and even have exchanged the evidence and investigation information after the raid.

So it is necessary to pay attention to the actions of major competition authorities in the US and EU as well the KFTC. If the international cartel investigation commences or is likely to commence in major countries such as the US and/or EU, it is necessary to recognize that the KFTC is likely to commence its investigation on the same matter as well, and vice versa. Once the KFTC investigates an international cartel case, it is highly likely that the same issues will be raised by the US and EU competition authorities later on.

Importance of Initial Strategic Countermeasure

As is the case in general cartel cases, most of the international cartel cases are usually initiated by leniency. Thus, an enterprise being threatened with an international cartel investigation will be faced with the decision on how best to react. Such enterprise will have to make a decision as to whether their reaction should be: 1) to strategically file an application for leniency prior to the commencement of investigation; 2) to deny the alleged conduct during the course of investigation; 3) to be subject to the reduction of fine as the later leniency applicant; or 4) to continuously deny the allegation. Thereafter, such enterprise should also be prepared to react to any civil lawsuits instituted in order to seek compensation for damages.

How one reacts in the initial stage of the international cartel case as well as the leniency program tends to sway the entire result of the case. Thus, it is urgently required to select a qualified counsel in Korea who will advise the enterprise on the most appropriate strategy at various stages (before the investigation commences, during the investigation is under way, and after the investigation is completed) upon taking into account the facts of the case and investigation history. It is absolutely necessary to secure a counsel in Korea who is well aware of internal affairs of the KFTC and is able to smoothly communicate with the relevant officials at the KFTC before proceeding with any case.

|